MSME Certificate in India – How to Apply | Complete 2025 Guide

Small and medium enterprises can obtain an MSME certificate in India to access government benefits, loans, and subsidies. You can apply for an MSME certificate in India by registering your business on the official Udyam Registration portal. As the backbone of the Indian economy, MSMEs enjoy numerous schemes, incentives, and support under the MSMED Act. Before applying, make sure you meet the eligibility criteria and prepare all required documents for your MSME certificate in India.

The full form of MSME is Micro, Small, and Medium Enterprises. These industries play a crucial role in the economy of a developing country like India, forming the backbone of the nation’s growth. As MSMEs grow, the overall economy flourishes. These industries are also commonly called small-scale industries.

Whether a business operates in manufacturing or services, entrepreneurs can register under the MSME Act. Although the government does not make registration mandatory, obtaining an MSME certificate in India provides significant advantages, including tax benefits, easier business setup, access to credit facilities, and loans.

The MSME framework became operational on October 2, 2006. The act was established to promote, facilitate, and enhance the competitiveness of micro, small, and medium enterprises. Applying for an MSME certificate in India ensures businesses can fully leverage these benefits and opportunities.

Details Required for the MSME Registration:

- APPLICANT NAME

- MOBILE NUMBER

- EMAIL ID

- OFFICE ADDRESS

- SOCIAL CATEGORY

- AADHAAR NUMBER

- PAN CARD NUMBER

- BANK ACCOUNT NUMBER

- IFSC CODE

- DATE OF COMMENCEMENT OF BUSINESS

- TYPE OF ORGANIZATION

- MAIN BUSINESS ACTIVITY OF ENTERPRISE

- NUMBER OF EMPLOYEES

- INVESTMENT IN PLANT & MACHINERY / EQUIPMENT

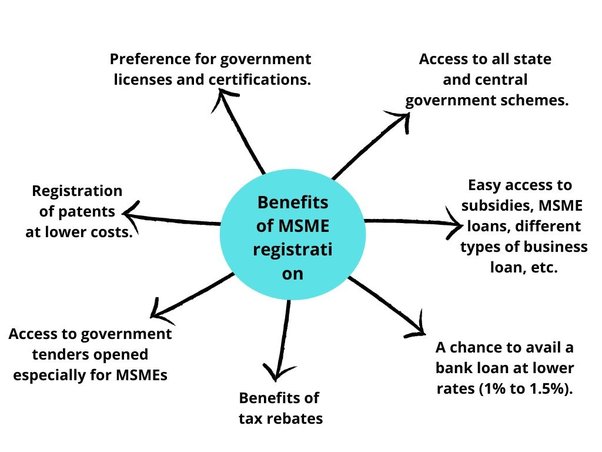

Advantages of registering in the MSMED act

Registering into the MSMED Act is not a legal requirement. But doing it offers you the following benefits

- Collateral-Free Loans for MSMEs

The Government of India provides collateral-free loans to MSMEs across the country. With an MSME certificate in India, you can access funds to start your venture or expand your existing business. The Credit Guarantee Trust Fund Scheme, managed jointly by the Government of India, the Small Industries Development Bank of India (SIDBI), and the Ministry of MSMEs, ensures smooth implementation of this program.

- Subsidy for Patent Registration

Entrepreneurs with an MSME certificate in India can avail a 50% subsidy on loans for patent registration. This benefit, provided under the Ministry of MSMEs, encourages innovation and intellectual property protection.

- Government Subsidies for Industrial Promotion

Registering under the MSMED Act makes your business eligible for government subsidies to promote products and services. This helps MSMEs grow faster and compete effectively in the market.

- Lower Interest on Loans and Overdraft Facilities

MSMEs holding an MSME certificate in India enjoy 1% lower interest on overdraft facilities. Additionally, registered MSMEs are eligible for a 2% interest subvention on incremental loans below INR 1 crore. These benefits reduce financial burdens and improve cash flow.

- Low-Interest Loans for MSMEs

In addition to overdraft exemptions, MSMEs registered in India under the MSMED Act can avail a 2% interest subvention on incremental loans below INR 1 crore. Obtaining an MSME certificate in India ensures your business qualifies for these financial benefits, reducing the cost of borrowing and supporting growth.

- Reimbursement for ISO Certification

MSMEs holding an MSME certificate in India can claim reimbursement for expenses incurred while obtaining certifications like ISO 9000 and ACCP. This support helps businesses enhance performance, quality standards, and credibility across sectors.

- Incubation Scheme for MSMEs

Launched by the Government of India in 2019, the incubation scheme helps aspiring entrepreneurs develop innovative ideas into market-ready products. MSMEs with an MSME certificate in India can receive the following assistance:

- Financial assistance up to INR 15 lakh to nurture innovative ideas.

- Loans up to INR 1 crore to procure and install machinery, strengthening R&D activities.

- Seed capital support up to INR 1 crore in the form of grants to transform ideas into viable ventures.

- Financial Assistance and Grants

MSMEs with an MSME certificate in India can access financial assistance up to INR 15 lakh to nurture innovative ideas. Additionally, the government provides loans up to INR 1 crore to procure and install machinery, strengthening R&D activities. Entrepreneurs can also receive up to INR 1 crore as seed capital support in the form of grants to transform ideas into viable ventures.

- Market Development Scheme

The Central Government has implemented a price and purchase preference mechanism covering up to 358 products. The government buys these products exclusively from MSMEs registered in India under the Act. Even units outside reserved categories can receive marketing support under this scheme, helping them expand their reach and sales.

- Protection Against Delayed Payments

Buyers sometimes delay payments for products or services purchased from MSMEs. The Ministry of MSMEs steps in to assist registered businesses, allowing them to levy interest on delayed payments. Settlements occur through arbitration and conciliation, ensuring that issues are resolved quickly.

- Tax Benefits for Innovative Startups

Startups with an MSME certificate in India and innovative operations may receive 100% tax exemption for three out of seven years. Furthermore, turnover should not exceed INR 2.5 crore in any financial year. This benefit also allows carry-forward of minimum alternative tax credits for up to 15 years.

- Lower Electricity Bills

Registered MSMEs are eligible for electricity bill concessions. To claim this benefit, businesses must submit their MSME certificate in India along with an application to the Electricity Department.

- Preference in Government Tenders

The Government of India reserves certain tenders exclusively for ventures holding an MSME certificate in India. This ensures fair competition for domestic enterprises, especially as the government limits global tenders for investments exceeding INR 20 crore.

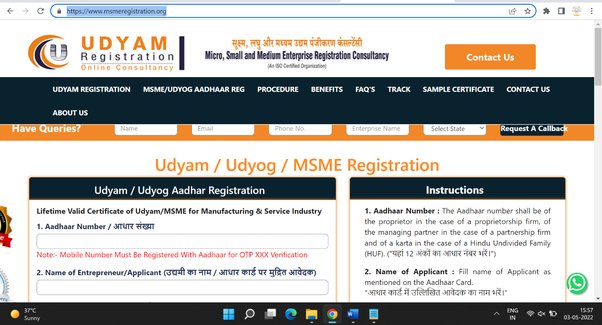

How to Apply for an MSME Certificate in India

Step-1: Start Registration Process

Click here to start the MSME Registration Process.

Step 2: Fill Application Form

APPLICANT NAME: Applicant should fill their Name as mentioned on Aadhaar card.

MOBILE NUMBER: Give correct Mobile Number of the Applicant, please avoid Country Code

EMAIL ID: Fill correct E-Mail ID of the Applicant, as Certificate & and Acknowledgement will be sent to registered Mail ID.

OFFICE ADDRESS: Applicant should Fill his/her proper office Address with State and Pin code.

SOCIAL CATEGORY: Applicant can choose social categories from the given option.

AADHAAR NUMBER: Applicant are required to mention his/her 12-digit Aadhaar number issued by UIDAI.

PAN CARD NUMBER: Applicants are required to mention their PAN Card number. (In case of proprietorship, Enter Owners Pan Number).

BANK ACCOUNT NUMBER: Fill the applicant Bank Account Number as mentioned on Passbook.

IFSC CODE: Fill the Applicant Bank IFSE Code as Mentioned on Passbook.

DATE OF COMMENCEMENT OF BUSINESS: Fill in the Date of your Company’s Incorporation or Registration, which will be printed on your certificate.

TYPE OF ORGANIZATION: Select the type of Organization from the given options, as it will get printed on the certificate.

MAIN BUSINESS ACTIVITY OF ENTERPRISE: Select the main activity from the given options.

ADDITIONAL DETAILS ABOUT BUSINESS: If you want you can fill more details about your business.

NUMBER OF EMPLOYEES: Enter the number of active Employees in your organization.

INVESTMENT IN PLANT & MACHINERY / EQUIPMENT: Enter the Applicant’s total investment in plant, machinery and equipment etc. to start his/her business.

SUBMIT APPLICATION: Click the submit button once the Applicant submitted all of required details and documents.

Step 3: Executive Will Process Application

At this process, an MSME executive will review your application. In case of any discrepancy, you will be notified about the process and make the relevant changes.

Step 4: Receive Certificate of Mail

After filling the complete form, you will get the certificate for MSME Registration. To know how it would be, you can download a copy of the Sample MSME Certificate. The Ministry will not issue you any hard copy for it. You will get a virtual certificate for MSME Registration.

This is the process for the MSME registration for companies. Note that the entire registration process is free of cost. However, there are many online portals that do the registration process on behalf of the companies at a certain fee.

NOTE: AFTER THE PAYMENT IS MADE SUCCESSFULLY DOCUMENT (AADHAAR CARD & PAN CARD) SUBMISSION WILL BE REQUIRED.

Frequently Asked Questions (FAQs):

MSME Certificate (Udyam Registration) is an official recognition for small and medium businesses in India under the MSMED Act. It helps businesses avail benefits like subsidies, loans, and legal protections.

Any small or medium business, including proprietorship, partnership, or company, can apply for MSME registration if it meets investment or turnover criteria defined under the MSMED Act.

Yes, MSME registration (Udyam Registration) is free for all businesses in India. No fees are required to register online through the official portal.

Easy access to loans and credit

Lower interest rates

Government subsidies and schemes

Protection against delayed payments

Reimbursement for ISO/quality certifications

You can apply online via the Udyam Registration portal or follow a step-by-step guide on My Legal Tax to complete registration easily.

Leave a Reply