Organization DSC Online– Apply Online

Authenticate your organization digitally for MCA, GST, Tenders, and more.

Submit Your Details

What is an Organizational DSC?

An Organizational Digital Signature Certificate (DSC) online is a secure electronic credential issued to a company, firm, or organization. It verifies the identity of the organization and its authorized signatories for online transactions and digital document submissions. Organizational DSCs are essential for corporate compliance activities such as filing forms with the Ministry of Corporate Affairs (MCA), GST returns, e-tendering, and other secure digital communications. They ensure data integrity, authentication, and non-repudiation, making online processes safe, legal, and efficient.

To explore all other Digital Signature Certificate options, you can also check our complete DSC services page.

Types of Organizational DSC?

Organizational DSCs are categorized based on their usage and security level. The main types include:

| Type of DSC | Usage |

|---|---|

| Class 2 Organizational DSC | GST filing, Income Tax e-filing, MCA forms, company compliance submissions. |

| Class 3 Organizational DSC | E-tendering, e-procurement, high-security corporate transactions. |

| DGFT DSC | Import/export documentation and filings with the Directorate General of Foreign Trade. |

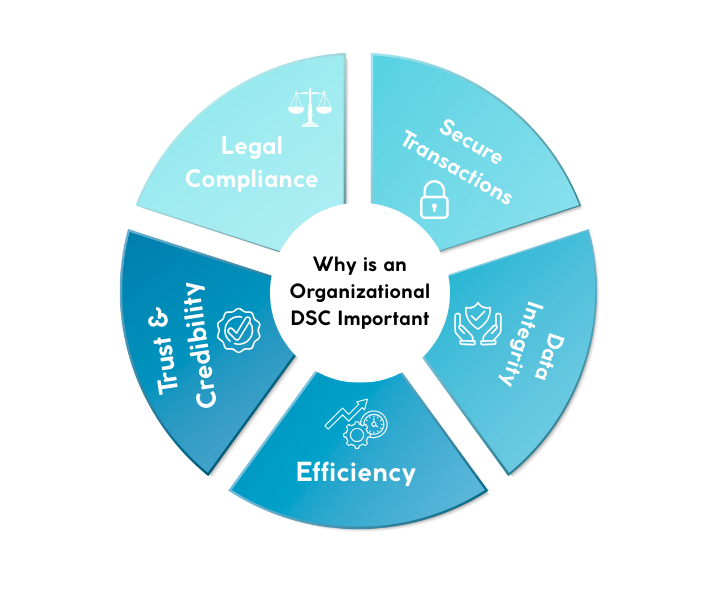

Why is an Organizational DSC Important?

An Organization DSC online is essential because it provides a secure and legally valid way to authenticate your company’s digital identity. In today’s digital world, where most corporate compliance and government processes are conducted online, an Organizational DSC ensures:

- Legal Compliance — Required for MCA filings, GST returns, and e-tendering.

- Secure Transactions — Ensures authentication and protects against fraud.

- Data Integrity — Guarantees documents are not altered after signing.

- Efficiency — Speeds up corporate compliance processes.

- Trust & Credibility — Builds confidence in digital communications.

Who Needs an organizational DSC?

An Organization DSC Online is required by companies, firms, and organizations that need to file documents or conduct secure transactions online. It is essential for:

- Companies registered with the Ministry of Corporate Affairs (MCA) for compliance filings.

- Businesses participating in e-tendering or e-procurement.

- Organizations filing GST returns or Income Tax electronically.

- Importers and exporters dealing with DGFT documentation.

- Any company needing to digitally sign official documents for legal authenticity.

Who Needs an organizational DSC?

- Scan copy of PAN Card of Applicant – Proof of identity.

- Applicant Passport Size Photo – Recent photograph of the authorized person.

- GST Registration Certificate – Proof of business registration

Other Details Required:

- Email ID of Applicant (for DSC process)

- Mobile Number of Applicant (for DSC process)

How to Apply for Individual DSC

Organizational DSC Application Process

Fill Online Application Form

Visit the DSC provider’s portal and complete the Organizational DSC application form with accurate details.

Upload Required Documents

Submit scanned copies of the PAN card, passport-size photograph, GST certificate, and other necessary documents.

Verification Process

The DSC provider will verify your documents and details with the organization and authorized signatory.

Payment & Issuance

Make the payment for the DSC package chosen. Once verification is complete, the Organizational DSC will be issued.

Receive DSC USB Token

The DSC will be delivered via a secure USB token, which can be used for signing documents and filing forms.

Why Choose My Legal Tax

At My Legal Tax, we make the process of obtaining your Organization DSC Online Certificate fast, secure, and hassle-free. Here’s why businesses trust us:

Quick & Easy Process

Apply online with minimal paperwork.

Trusted & Secure

Compliance with government standards for DSC issuance.

Expert Support

Guidance for MCA filings, GST returns, and e-tendering.

Affordable Pricing

Transparent rates with no hidden charges.

Hassle-Free Application

We handle all documentation & submissions.

Frequently Asked Questions

Companies, firms, LLPs, and organizations involved in government filings, e-tendering, or secure online transactions require an Organizational DSC.

Typically, Organizational DSCs are valid for 1 or 2 years, depending on the type of certificate purchased. Renewal is required upon expiry.

No, an Organizational DSC is issued to a specific organization and registered signatory. Each authorized signatory needs a separate DSC if required.

Yes, Organizational DSCs are legally valid under the Information Technology Act, 2000.

Secure Your Organization’s Digital Identity Today

Get your Organizational DSC quickly and easily with My Legal Tax — trusted by businesses for fast, secure, and legal digital authentication.