Register Your Company Hassle-Free with Legal Experts

Trusted experts for Pvt Ltd, LLP & OPC registration — done right the first time.

Fill the form below to register your company with ease and legal compliance.

Company Registration in India?

Company Registration in India is the legal process of forming a new business and officially registering it with the Ministry of Corporate Affairs (MCA). Once registered, the company becomes a separate legal entity, distinct from its owners, with its own rights, obligations, and liabilities. This process provides the business with legal recognition, credibility, and protection — enabling it to operate independently and grow with confidence.

Key Features of Company Registration:

- Separate Legal Entity – Company has its own legal status, separate from its shareholders.

- Limited Liability – Owners’ personal assets are protected against business losses.

- Perpetual Succession – Company continues to exist even if ownership changes.

- Access to Capital – Easier to raise funds from banks, investors, and venture capital.

- Tax & Government Benefits – Eligible for Startup India, MSME registration, subsidies, etc.

What is Company Law in India?

Company Law in India refers to the set of rules and regulations that govern the formation, management, and operations of companies. The primary legislation is the Companies Act, 2013, which is administered by the Ministry of Corporate Affairs (MCA).

It defines how companies are incorporated, their responsibilities, compliance requirements, rights of directors and shareholders, and the legal framework for mergers, winding up, and corporate governance.

Documents Required for Company Registration in India

To register a company in India under the Companies Act, 2013, the Ministry of Corporate Affairs (MCA) requires complete and verified documentation for all directors, shareholders, and the registered office address. Submitting accurate, up-to-date documents ensures faster processing, minimises compliance risk, and helps avoid incorporation delays with the Registrar of Companies (ROC).

- Documents for Directors and Shareholders

- Passport-sized photograph (recent, color, and clear)

- PAN Card (mandatory for all Indian citizens)

- Identity Proof (any one of the following): Aadhaar Card, Passport, Voter ID and Driver’s License

- Residential Address Proof (any one of the following, not older than 60 days): Utility bill (electricity, gas, water), Bank statement, and Mobile or landline phone bill

- Digital Signature Certificate (DSC): Required to electronically sign incorporation documents submitted to the MCA portal

- Director Identification Number (DIN): Mandatory unique ID for each proposed director under Section 153 of the Companies Act

- Foreign nationals must submit notarized and apostilled copies of identity and address proof as per Indian regulatory standards.

- Documents for Registered Office Address

- Proof of Address (dated within 60 days): Electricity bill, Water bill and Property tax receipt

- No Objection Certificate (NOC): Issued by the property owner allowing use of the premises for business registration

- Tenancy or Ownership Proof: Registered rental agreement (if leased), Property ownership deed (if owned)

- Director and Shareholder Details: Full Name, Date of Birth, Nationality, Occupation and Percentage of shareholding (if applicable)

Types of Company Registration in India We Provide

Private Limited Company

A Private Limited Company (Pvt Ltd) is the most popular business structure for startups and growing businesses. It offers limited liability protection to its shareholders, separate legal identity, easy funding opportunities, and greater credibility.

Limited Liability Partnership (LLP)

An LLP is a hybrid business structure that combines the flexibility of a partnership with the benefits of limited liability protection. It is suitable for professionals and small businesses seeking lower compliance requirements while protecting personal assets.

One Person Company (OPC)

An OPC is ideal for solo entrepreneurs who want to enjoy the benefits of a corporate structure with limited liability. It allows a single person to own and manage the company while having a separate legal identity.

Producer Company

A Producer Company is formed by farmers, producers, or primary producers with the aim of improving production, harvesting, processing, and marketing of their produce. It helps collective farming and business growth in agriculture and allied sectors.

Nidhi Company

A Nidhi Company is a non-banking financial company (NBFC) recognized under the Companies Act, 2013. Its main objective is to borrow and lend money between members, promoting mutual benefit and financial inclusion.

Section 8 (Non-Profit) Company

A Section 8 Company is a non-profit organization formed for promoting arts, commerce, charity, science, sports, education, or any other useful objective. It enjoys special tax exemptions and is regulated under the Companies Act, 2013.

Public Limited Company

A Public Limited Company can raise capital from the public by issuing shares or debentures. It is suitable for large-scale businesses and is regulated under the Companies Act. It requires higher compliance compared to private companies.

Foreign Subsidiary & Wholly Owned Subsidiary (WOS)

A Foreign Subsidiary or WOS is a company incorporated in India that is fully or partly owned by a foreign company. It allows foreign businesses to operate in India while maintaining control over operations and complying with local regulations.

Convert Business (Partnership & LLP)

This process allows an existing Partnership Firm or LLP to be converted into a Private Limited Company or other corporate structure. It is beneficial for businesses seeking better governance, credibility, and funding opportunities.

Eligibility Criteria for Company Registration in India

| Criteria | Description |

|---|---|

| Minimum Directors | At least 2 directors for a Private Limited Company and OPC, and at least 3 directors for a Public Limited Company. |

| Minimum Members | Private Limited Company: 2–200 members; Public Limited Company: Minimum 7 members; One Person Company: 1 member; Others vary. |

| Director Requirements | Directors must be at least 18 years old, Indian residents (for at least 182 days in the preceding year), and not disqualified by law. |

| Shareholders | Shareholders can be individuals or corporate entities; for OPC only one shareholder is allowed. |

| Registered Office | Must have a physical registered office in India with valid address proof. |

| Digital Signature Certificate (DSC) | Required for all proposed directors to sign documents electronically. |

| Director Identification Number (DIN) | Every proposed director must have a DIN issued by the Ministry of Corporate Affairs (MCA). |

| Name Availability | The proposed company name must be unique and approved by the Registrar of Companies (RoC). |

| Capital Requirement | No minimum capital required for most types of companies except specific cases like banking companies. |

| Compliance with MCA Rules | Must follow the Companies Act, 2013, and rules prescribed by MCA. |

Checklist for Company Registration in India

| Checklist Item | Details |

|---|---|

| Company Name Approval | Choose a unique name and apply for name approval through MCA. |

| Digital Signature Certificate (DSC) | Obtain DSC for proposed directors. |

| Director Identification Number (DIN) | Apply for DIN for all directors. |

| Registered Office Proof | Address proof (electricity bill, rental agreement, etc.) and NOC from property owner. |

| MOA & AOA Drafting | Draft Memorandum of Association (MOA) and Articles of Association (AOA). |

| Significant Documents | PAN Card, Aadhaar Card, Passport-sized photographs of directors/shareholders. |

| Capital Requirement | Decide authorized capital and issue shares accordingly. |

| Filing with MCA | File incorporation application through SPICe+ form on MCA portal. |

| Payment of Fees | Pay registration, stamp duty, and government fees. |

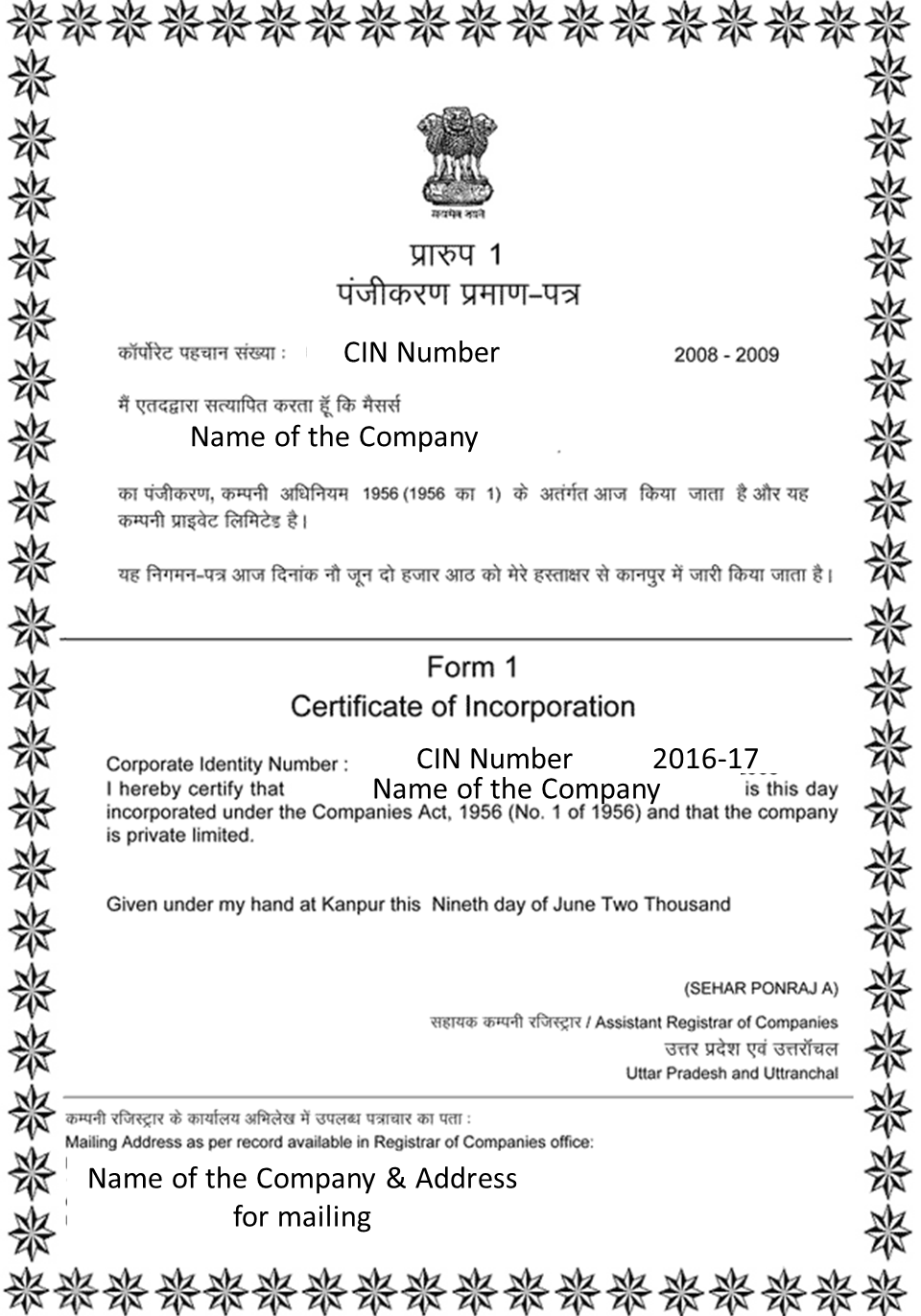

| Certificate of Incorporation | Receive CoI from Registrar of Companies after approval. |

| Commencement of Business | File declaration (if required) and obtain necessary licenses or registrations. |

Step-by-Step Company Registration in India Process

Private Limited Company (Pvt Ltd): Ideal for startups; offers limited liability and eligibility for equity funding.

Limited Liability Partnership (LLP): Flexible structure with partnership-style governance and corporate shielding.

One Person Company (OPC): For solo founders seeking legal separation from personal assets.

Public Limited Company (PLC): Suitable for large-scale ventures planning to raise public capital.

Sole Proprietorship / Partnership: Simplified models with basic compliance; not eligible for a Company Registration Certificate.

- The SPICe+ incorporation form, or a separate DIN application on the MCA portal.

Time Estimate: 1 working day.

How to Apply: Use licensed authorities like eMudhra, Sify, or Ncode.

Submit PAN, address proof, and photograph.

Time Estimate: 1–2 working days.

Check availability using MCA RUN service.

Comply with Companies (Incorporation) Rules, 2014.

Name reserved for 20 days after approval.

Time Estimate: 1–2 working days.

AoA: Governs internal procedures, director roles, and voting rights.

Must be signed digitally by all subscribers and directors.

DIR-2: Written consent from each director to act in that capacity.

Attach: MoA, AoA, DIN, DSC, ID/address proof, registered office documents, INC-9, DIR-2.

File AGILE-PRO-S for GST, EPFO/ESIC, Professional Tax, and bank account setup.

Advantages of Company Registration in India

What is a Company Registration Certificate?

A Company Registration Certificate (CoR) is an official document issued by the Registrar of Companies (RoC) under the Ministry of Corporate Affairs (MCA) in India. It serves as proof that a company has been legally incorporated under the Companies Act, 2013.

The certificate confirms that the company is now a separate legal entity, recognized under Indian law, and is authorized to operate its business.

Key Details Included in a Company Registration Certificate:

- Company name

- Corporate identity number (CIN)

- Date of incorporation

- Company type (Private Limited, Public Limited, etc.)

- Registered office address

- Authorized share capital

- RoC details

Post Incorporation Compliances in India

- Issue share certificates within 2 months.

- File declaration of commencement of business (INC-20A).

- Maintain statutory registers.

- File annual returns (AOC-4, MGT-7) with MCA.

- File company income tax return each financial year.

- EPF & ESI registration for eligible employees.

- Professional tax registration.

- Labour law compliances.

- Maintain proper accounts and records.

- Comply with Companies Act & applicable laws.

Why choose us?

Expert Guidance

Experienced team providing end-to-end company registration services.

Transparent Process

Complete clarity with no hidden charges or delays.

Quick Turnaround

Fast and efficient processing to save your time.

Compliance Support

Assistance with all post-incorporation compliances.

Customized Solutions

Tailored services based on your business needs.

Affordable Pricing

High-quality service at competitive rates.

Frequently Asked Questions

Company registration is the process of legally incorporating a company with the Registrar of Companies (RoC) under the Companies Act, 2013. It gives your business a legal identity.

It provides limited liability protection, legal recognition, credibility, and the ability to raise funds easily.

Common types include Private Limited Company, Public Limited Company, Limited Liability Partnership (LLP), and One Person Company (OPC).

Generally, it takes 7–15 working days if all documents are in order.

Documents include identity proof, address proof of directors/shareholders, registered office proof, and digital signatures.

Yes, foreign nationals or companies can register in India subject to FEMA regulations.

Filing annual returns, conducting board meetings, maintaining statutory registers, GST registration, tax filings, and more.

Yes, PAN and TAN are mandatory for filing income tax returns and complying with tax obligations.

Ready to Register Your Company

Get started today and launch your business with confidence.